Mumbai | June 17, 2025 — Tata Motors, once riding high on auto sector momentum, is now skidding through a sharp financial curve. Investors were jolted as the company’s stock continued its southward slide, sending shockwaves across D-Street. The stock price crashed nearly 10% on April 7, and the bleeding hasn’t stopped — with a staggering 39% erosion in value over the past six months.

But what exactly is spooking the bulls? Let’s break down the crash:

🛑 JLR Shipment Freeze to U.S. Sparks Panic

The immediate trigger? Jaguar Land Rover (JLR) — Tata Motors’ UK-based luxury jewel — announced a temporary halt in shipments to the United States, one of its biggest global markets. This unanticipated move sent a red alert across portfolios as analysts forecast a short-term revenue drought from the U.S. market.

📉 Earnings Report Dims the Outlook

Despite beating Street expectations, Tata Motors reported a whopping 51% year-on-year drop in its consolidated Q4FY25 net profit. Even with JLR’s margin recovery and a robust commercial vehicle performance, investors weren’t convinced. Revenue stayed flat, and poor guidance didn’t help soothe nerves.

💸 The Domino Effect: Losses Stack Up

- Past 5 Trading Days: 17.12% fall

- Last 30 Days: 15% value erosion

- Six-Month Decline: 39.42% nosedive

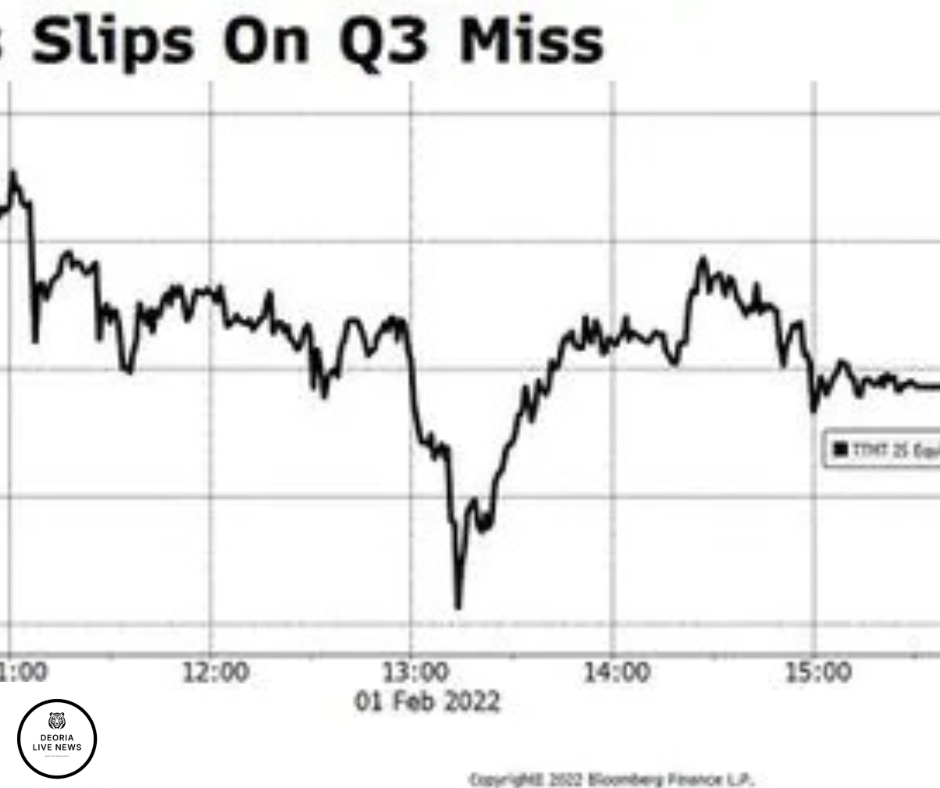

Add to this a wider-than-expected Q3 loss — courtesy of supply chain bottlenecks and raw material cost spikes, and you have a cocktail of investor anxiety.

🇺🇸 Trump’s 25% Import Tariff Threatens JLR’s U.S. Market

Making matters worse, former U.S. President Donald Trump’s proposed 25% tariff on imported automobiles is raising red flags for JLR’s sales in the States. If implemented, it could inflate prices of JLR vehicles, turning American buyers away and throttling revenue from a key territory.

🧾 Analyst Downgrades & Ratings Cuts Add Fuel to Fire

Several credit rating agencies have downgraded Tata Motors’ outlook, citing volatile earnings, JLR’s ongoing crisis, and softening demand. A barrage of bearish brokerage notes has only deepened the investor exodus.

📊 Current Stock Snapshot

- As of June 16, 2025: ₹700.45

- Previous Close: ₹715.35

- Daily Decline: 1.63%

💬 Market Experts React

“It’s a perfect storm — operational headwinds, geopolitical uncertainty, and muted earnings. The stock’s outlook remains under pressure unless Tata Motors revamps strategy and regains JLR’s traction in core markets,” said R.K. Nambiar, a senior auto sector analyst.

📌 What Lies Ahead?

Tata Motors must now navigate a tough road ahead — fixing JLR’s U.S. disruption, weathering macroeconomic shocks, and reigniting investor confidence. The upcoming quarterly performance and clarity around U.S. tariffs could decide whether the stock rebounds or continues to spiral.