Global financial markets saw a strong start today after the United States and China agreed to extend their existing tariff truce by another 90 days. The decision, aimed at keeping trade talks alive, delayed a planned round of tariff increases and gave investors a reason to breathe a little easier.

Wall Street futures moved higher, with major U.S. indices set for a positive open. In Asia-Pacific, Australian shares posted solid gains, while other regional markets, including Japan and South Korea, followed suit. European stocks also saw early momentum, reflecting a wave of renewed optimism.

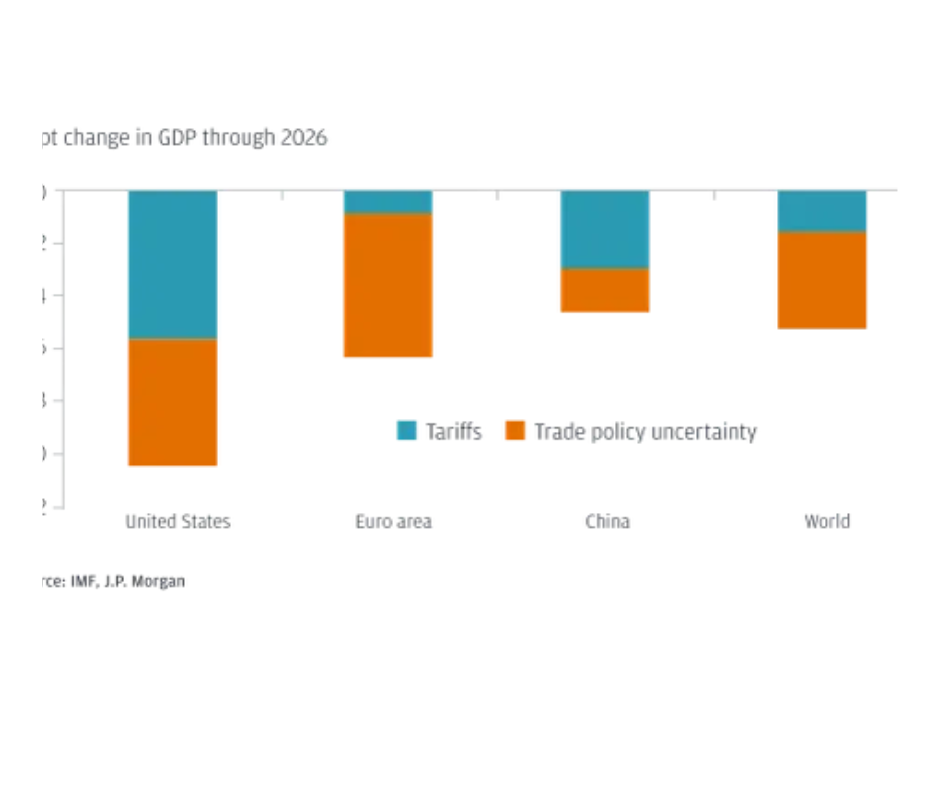

For months, markets have been sensitive to every twist in the U.S.–China trade dispute. Tariffs on billions of dollars worth of goods have weighed on corporate profits, disrupted supply chains, and created uncertainty for global trade. By extending the truce, both sides have bought more time to negotiate — although key differences remain unresolved.

Analysts say that while the news is a relief in the short term, investors should be cautious. The extra 90 days are a window for talks, not a guarantee of resolution. Any setback or breakdown in negotiations could quickly reverse the market’s upbeat mood.

For now, the extension has shifted sentiment toward riskier assets, with investors moving back into equities and away from safe-haven assets like gold.

As the countdown to the new tariff deadline begins, markets will be watching closely for signs of progress in Washington and Beijing. Whether this is the start of a long-term easing of tensions or just a temporary pause remains to be seen.